COVID-19 has given the senior care and housing industry unprecedented operational and financial challenges. These providers have been forced to weather a COVID-19 storm, escalating the already difficult staffing shortage, increasing regulatory scrutiny, and thinning bottom lines. The good news is that in order to address the COVID-19 public health emergency fiscal burdens, Congress and various federal agencies have made available federal funding. Unfortunately, the multiplicity of programs and the speed at which they were rolled out can leave providers bewildered about applying for funds (when applicable) and for ensuring that the funding received is spent appropriately—all with limited and, in some cases, rapidly evolving guidance.

CARES Act Provider Relief Funds

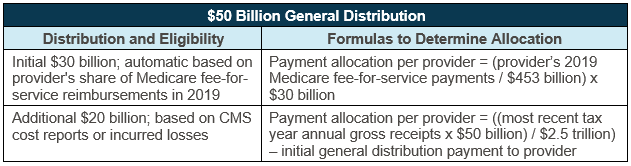

In April 2020, the U.S. Department of Health & Human Services (HHS) identified $50 billion as general distribution through the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The general distribution funding has been distributed in two tranches to date.

In developing the general distribution methodology, HHS had to balance speed with accuracy and fairness. To that end, the first distribution used a formula based on 2019 Medicare claims, while the second is based on cost reports, netted against the initial distribution. These are described in the table below.

The general distribution methodology is ultimately designed to deliver relief to providers who bill Medicare fee-for-service with at least 2 percent of that provider’s net patient revenue regardless of the provider’s payer mix. Payments are determined based on the lesser of 2 percent of a provider’s 2018 (or most recent complete tax year) net patient revenue or the sum of incurred losses for March and April 2020. (Note: not all providers necessarily got a second distribution if the initial distribution was calculated to be sufficient. Providers had until June 3, 2020, to request a second distribution if they did not receive one and they met the criteria.)

Source: U.S. Department of Health & Human Services; retrieved from: https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/general-information/index.html

On May 22, 2020, HHS made a targeted distribution to skilled nursing facilities of $4.9 billion in total. The calculation for those payments included a base amount of $50,000, plus a distribution of $2,500 per bed. These payments were a big relief to skilled nursing providers who were inadequately recognized in the $50 billion general distribution.

On June 9, 2020, HHS announced another tranche funding targeted to Medicaid providers, who will have to apply online in order to receive funds from this distribution. Among the provider types that appear to be targeted for these funds are Medicaid-funded assisted living facilities and home- and community-based services organizations such as adult day care. Notably, Programs of All-inclusive Care for the Elderly (PACE) programs are excluded from this distribution as they are considered payors for purposes of the Provider Relief Fund.

This new funding is only available to entities that did not receive any funds out of the first $50 billion general distribution and that did not permanently go out of business. Multi-service line providers that have already received general distribution funds, but also operate these type of Medicaid programs, should carefully review tax identification numbers of the entities that have already received funds and whether these Medicaid service lines are eligible for additional funding.

Conditions for Fund Use

As a condition for retaining the received HHS funds, every provider receiving a payment is required to attest to meeting the terms and conditions as laid out in the HHS portal. Providers should ensure that all attestations are appropriately submitted to the HHS portal by the deadlines posted (for example, attestations for Provider Relief Funds are due 90 days from receipt of funds). Unfortunately, the language in the terms and conditions is relatively vague and leaves providers with many questions. Providers must certify that the payments will:

- Only be used to prevent, prepare for, and respond to coronavirus; and,

- Reimburse the recipient only for health care-related expenses or lost revenues that are attributable to coronavirus.

HHS continues to refine the FAQ and guidance on these funds and other issues related to the provider relief funds, including guidance that may apply retroactively. Last week, HHS added more specific examples in their FAQ of what could fall under the definition of “healthcare related expenses attributable to coronavirus” to include supplies, workforce training, equipment for health care services, developing and staffing emergency operation centers, reporting costs, building or constructing temporary structure to expand capacity, and acquiring additional resources to expand or preserve care delivery.

Also, HHS stated, “HHS encourages the use of the funds to cover lost revenue so that providers can respond to the coronavirus public health emergency by maintaining healthcare delivery capacity, such as using Provider Relief Fund payments to cover payroll, employee health insurance, rent or mortgage payments, equipment lease payments and electronic health record licenses fees.”

One of the most challenging elements of accepting the terms and conditions for providers has been the ambiguity around the condition that provider relief funds may not be used to reimburse expenses or losses that have been reimbursed from other sources or that other sources are obligated to reimburse. This new clarification is helpful but still leaves uncertainty around what the reporting requirements will be and what documentation is necessary. It is important, therefore, that providers maintain detailed tracking of all COVID-related expenses and lost revenue.

In addition, we recommend keeping all stimulus or COVID-related funding in a separate account to ensure proper accounting and usage. It will be important for providers to continuously monitor these updated stipulations and seek counsel to ensure compliance with the terms and conditions.

Paycheck Protection Programs Loans

As of early June, the existing Paycheck Protection Program (PPP) had over $150 billion in unused funds. On Friday, June 5, President Trump signed into effect the Paycheck Protection Program Flexibility Act of 2020. This update included major favorable changes to the original PPP, including:

- Expands the original loan term from 2 years to 5 years.

- Loan forgiveness “covered period” can be extended to 24 weeks from 8 weeks after the date of origination.

- Recipients only required to use 60 percent or more of the covered loan amount for payroll costs versus the original 75 percent.

- Restore full-time equivalent employee level and restore reduced wages (reduced by more than 25 percent) to the February 15, 2020, levels by December 31, 2020. This date was originally June 30, 2020. If unable to hire the same (or similarly qualified) employees in “good faith” due to the compliance with federal guidance related to the maintenance of standards for sanitation, social distancing, or any other worker or customer safety requirement related to COVID-19 by December 31, 2020, there will not be an adverse effect on the forgiveness.

- Ability to defer payroll taxes incurred between March 27, 2020 and December 31, 2020.

In relation to the PPP loans and the provider relief funds, HHS released guidance on May 29 that stated, “There is no direct ban under the CARES Act on accepting a payment from the Provider Relief Fund and other sources, so long as the payment from the Provider Relief Fund is used only for permissible purposes and the recipient complies with the Terms and Conditions. By attesting to the Terms and Conditions, the recipient certifies that it will not use the payment to reimburse expenses or losses that have been reimbursed from other sources or that other sources are obligated to reimburse.”

This overlap of funds should be carefully monitored to ensure the PPP SBA loans and the provider relief funds are not used for the same COVID-related expenses.

FEMA COVID Grants

Funds for coronavirus relief may also be available under the Federal Emergency Management Agency (FEMA) for “critical” and “essential” private nonprofit providers (PNPs). Critical PNPs include nursing homes and rehab centers, while essential PNPs include senior centers.

While FEMA is a federal agency, the distribution of FEMA COVID grants is made through the designated state agency and pursuant to a state disaster declaration.

PNPs must identify the applicable state agency and then establish a grant application account, supplying information such as DUNs number and tax-exempt letter. The state agency will specify the scope of work, or equipment, that an eligible PNP may apply for, as well as the timeline for the applications and the completion of proposed projects.

Next Steps

In addition to the provider relief funds, the PPP loans, and the FEMA grants, we encourage operators to take a critical look at all of the COVID funding and grant opportunities available to them federally and in their states. States are tackling funding in various ways, and it is imperative for operators to ensure they are availing themselves of the most advantageous programs to their organization, as well as to understand how the various funding source requirements interplay with one another.

It is also critical to ensure that their finance teams understand the detailed requirements of each program and have the appropriate financial tracking mechanisms in place to navigate the various reporting requirements.

If you have questions or if HDG can assist you with financial advisory support in your preparedness and response to COVID-19, please contact us at info@hdgi1.com or 763.537.5700.

Additionally, to assist our clients, managed communities, and other providers in preparing for and responding to COVID-19, Health Dimensions Group created a Skilled Nursing & Senior Living COVID-19 Response & Resource Guide that is available for your download and use.