Senior living, post-acute, and long-term care (LTC) providers across the country are seeing a highly variable landscape in terms of rebound from the sharp drops in census witnessed at the onset of the pandemic. In some markets and for some levels of care, the rebound has been significant, while in other markets, there has been a significant and ongoing shift away from institutional care to residential and home-based care with services. What are the factors driving these changes, and how can providers prepare for the future?

Senior Living

Recent data issued by the National Investment Center (NIC) for 2Q 2022 shows that for majority independent living (IL) providers, occupancy has rebounded to 85 percent. This is up several percentage points over the 12-month prior period. Over that same time, for majority assisted living (AL) providers, occupancy has increased from 73 to nearly 80 percent. While this slight market rebound is positive news, the NIC report does indicate the overall June 2022 occupancy levels, for both IL and AL, are still about 6 percentage points lower than pre-pandemic levels, on average.

The NIC data indicates consistent patterns of overall occupancy growth across the country. In 27 of the 31 primary markets reviewed, IL or AL occupancy has either stayed the same or increased in the one-year period ending June 2022.

Skilled Nursing

For nursing communities, Health Dimensions Group (HDG) created a database in which we examined nursing home use per 1,000 Medicare beneficiaries for fourth quarter 2019 compared to fourth quarter 2021. This approach controls for changes in population over that time period. Several things stand out from this review:

- Even prior to COVID-19, there was substantial variation in nursing home use rates across the country. Pre-pandemic, there were 10 states where the number of nursing home residents per 1,000 Medicare beneficiaries was greater than 30, and there were 9 states where it was less than 15.

- Post-pandemic onset, there are only two states with more than 30 nursing home residents per 1,000 Medicare beneficiaries (North Dakota and Iowa), while there are now 17 states with less than 15 nursing home residents per 1,000, a major shift.

- The overall decline in nursing home use nationally has been about 15 percent over the two-year period from 4Q 2019 to 4Q 2021, but again there is variation.

- There are six states where the decline in nursing home use per Medicare beneficiary has been over 20 percent. Interestingly, five of those six states started out below the national average use rate in 2019 and are now even further below. Wisconsin is a case in point. The state’s use rate of nursing homes was about 85 percent of the national average pre-pandemic. Post-pandemic onset, it is 79 percent of the national average, indicating further retrenchment during COVID-19 in an already lean environment.

The reasons for this downward shift in nursing home use are varied and complex.

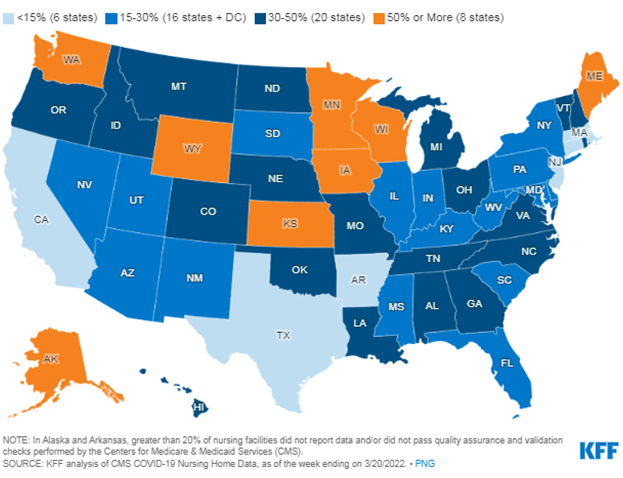

One of the main culprits is the shortage of direct care workers, particularly certified nursing assistants (CNAs). Nurse shortage data from 2021 analyzed by the Kaiser Family Foundation shows the magnitude of the problem and the variation by state (see Figure 1). This analysis shows considerable variation across states. When HDG dives into a specific market for a client, we see even more variation at a local level, often having to do with geography and particular market factors.

Figure 1: Share of Nursing Facilities Reporting Nurse Shortages as of March 20, 2022

Workforce shortages lead to closed units and a revenue spiral that becomes very challenging. When HDG does an in-depth market and operational analysis to assist our clients, we discover many important nuances that are driving localized staffing problems, and we frequently find that facilities are not using their existing staff efficiently. Moreover, the importance of operating culture on recruitment and retention cannot be overstated.

Workforce shortages lead to closed units and a revenue spiral that becomes very challenging. When HDG does an in-depth market and operational analysis to assist our clients, we discover many important nuances that are driving localized staffing problems, and we frequently find that facilities are not using their existing staff efficiently. Moreover, the importance of operating culture on recruitment and retention cannot be overstated.

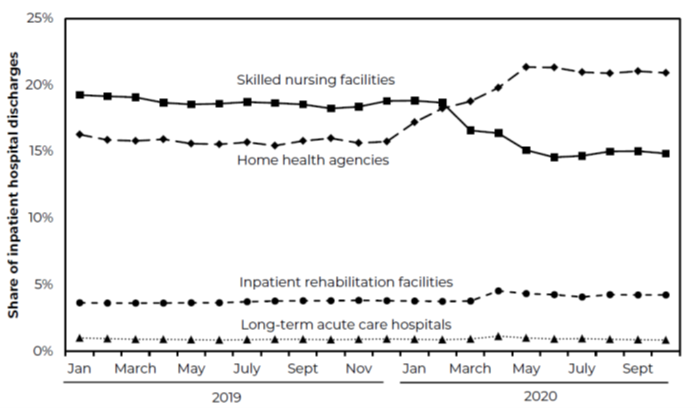

Another culprit in reduced occupancy is shifting referral patterns. Data from the Medicare Payment Advisory Commission (MedPAC) shows that the percentage of referrals to skilled nursing and home health basically flip-flopped during 2020, with home health being much higher than skilled nursing by the end of 2020. The use of inpatient rehabilitation facilities (IRFs) also ticked up in terms of the percentage of overall referrals. Figure 2 illustrates these trends for CY 2020.

Figure 2: Medicare Part A Referral Trends by Post-Acute Provider Type, 2019 to 2020

Source: MedPAC Databook

Source: MedPAC Databook

These changing referral patterns were influenced by several factors, including consumer preferences due to fear of COVID-19, payor policies, and the mindset of key referring physicians. The interaction of these trends in certain markets can create very powerful change.

For instance, in markets where there is greater than 40 percent penetration of Medicare Advantage plans, combined with state Medicaid policies promoting home- and community-based care (e.g., managed Medicaid long-term care, consumer-directed personal care, Programs of All-Inclusive Care for the Elderly), there has been a pronounced shift away from nursing homes during the pandemic, and in those cases, the markets are much less likely to rebound swiftly, if at all.

Inadequacy of Medicaid rates can also be a factor in nursing communities’ abilities to withstand occupancy drops, though there are some states that have finally started to make measurable changes in Medicaid payment after years of little or no increases (e.g., Pennsylvania recently enacted a 17 percent increase).

All of that said, we see some markets that have a great opportunity for growth due to projected trends in elderly population growth over the next five to 10 years. We also see some providers making strategic investments in capital plant designed to capture the interest of aging baby boomers and reflecting new market sensitivities (e.g., using technology to keep people home, improved HVAC systems, campus facelifts).

How Can HDG help?

As a national leader in senior care management and consulting services, Health Dimensions Group (HDG) can help your organization assess these opportunities and challenges as the market rebounds through market and operational review, along with strategic planning. The current environment has become very challenging for those who do not plan ahead and position themselves for the future.

For more information on how HDG can help you, please contact us at info@hdgi1.com or 763.537.5700.