For as long as senior living operators have been targeting services and housing at retirement-aged populations, there has been one market untapped, underserved, and mostly ignored: the middle market.

Who Exactly Is “The Middle”?

In general, the middle market is defined as seniors with too much income to qualify for income subsidy, but too little income to be Medicaid-eligible and qualify for government assistance programs. But the definition of the middle market is relative. Even if a household has the means to pay, it does not necessarily follow that it will choose to pay; some households are very price-sensitive even though they have plenty of money.

The definition of the middle market is also dependent on geographic region, due to variations in cost of living throughout the country. The middle market in metropolitan areas will have higher income, due to inflation, than the middle market in rural and small markets. Generally, middle market annual income is accepted to be $25,000–$100,000.

In the Chicago suburbs, for example, affordable housing options for the middle market are likely more pricey than similar options in a rural Illinois community. Metropolitan areas have a higher cost of living in general. A person with a $50,000 income in a small market in downstate Illinois will be able to afford much more than someone with the same income in the Chicago area.

These issues combine in a large segment of our older population, who will be in the market for the foreseeable future and have the resources to pay privately for moderately priced rental options that are not income restricted but do not have significant assets.

Furthermore, there are seniors who fall into high-income brackets who will demand moderately priced options. You will find that many seniors with means will be knocking on your door for tours and choosing options targeted for the middle market. These are cost-conscious, high-income seniors who are looking for value over frills. These seniors are looking for high-quality, affordable housing with supportive services at a price point that does not require them to spend down assets quickly, allowing them to age in place.

Like the higher-end markets, these seniors are looking for alternatives that offer more than just apartments, or “warehouses” for seniors. They want socialization and activities. They want chances to participate in the community both inside and outside their building. They are looking for a place to have a life—not just a place to live.

Understanding the Middle

Study after study indicates the middle market is one of the most pressing issues facing operators, developers, policy makers, funding agencies, and families. Here are two reasons why:

- The number of seniors in the middle-income bracket is increasing significantly—not only in the short term, but for the next 20 years or more. This segment has likely been the largest untapped group for as long as developers and operators have been providing seniors with housing.

- The supply of “affordable” products for the middle market is limited. Developers and operators are aware of these opportunities, so market demand studies are key to identifying supply and demand issues.

Why is the middle so large? First, the affordability gap is widening, in part due to the pandemic driving up the costs of labor and materials. Senior wealth and income lost during the pandemic is placing further stress on the middle and pushing more seniors into that segment, although much of the loss has been recovered based on recent stock market performance. More than half of seniors in the middle have mobility issues, while approximately a fifth have high-acuity and chronic conditions.

We need to recognize that, due to a lack of resources, many in the middle will be older than the average new resident by the time they enter our facilities and are in need of services. Seniors with lesser means will need assisted living (AL) services sooner than the wealthy, which will increase turnover of residents, ultimately increasing the need for you to develop solutions to maintain your occupancy.

One definite silver lining for seniors who own a home is the red-hot housing market in many areas of the country. Sales are up due to low interest rates and a lack of new housing in many areas, driving up prices and therefore liquidity for seniors—including those in the middle.

Population Growth

The average age of senior housing tenants and AL residents is over 85. We are not building for the 60-and-older markets, or even 70-and-older. You will see a higher number of people moving in at ages 75 and older than maybe you expect. Current operators are aware of this fact. For those of you considering senior housing development for the middle market for the first time, be aware that most of the demand is not from 55-and-older or even 65-and-older households—it’s from those much closer to age 85.

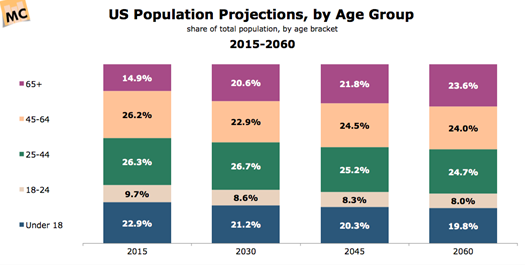

The 65-and-older population will be more than 20 percent of the total population by 2030; it will nearly double to more than 95 million people by 2060 (see Figure 1). In other words, the senior markets are growing almost in perpetuity. We believe that the need for senior housing and AL care, including memory care options, will increase proportionally to the population growth, barring unforeseen issues such as the pandemic we are currently living through.

Figure 1

Sources: U.S. Census Bureau, MarketingCharts.com

Sources: U.S. Census Bureau, MarketingCharts.com

The market is further segmented by geography, age, and income. Rural areas have the highest concentration of older adults and are aging faster than urban areas—the median age is nearly six years older in rural areas. Income levels in rural and smaller markets are generally lower than those in urban and metro markets. The largest opportunity for growth in the senior housing and AL segment is in these medium and smaller communities, and a higher percentage of these households will fall into the middle.

One significant challenge of meeting the demand of middle market growth is facility staffing. The ratio of younger adults for each person 65 and older and 85 and older is shrinking for the foreseeable future. This will result in a smaller worker pool for senior housing and AL care. Choosing to develop in areas where adults ages 25–55 are living and working will help offset this trend. Attracting workers to the industry with higher wages and better benefits than the next best alternative will be necessary.

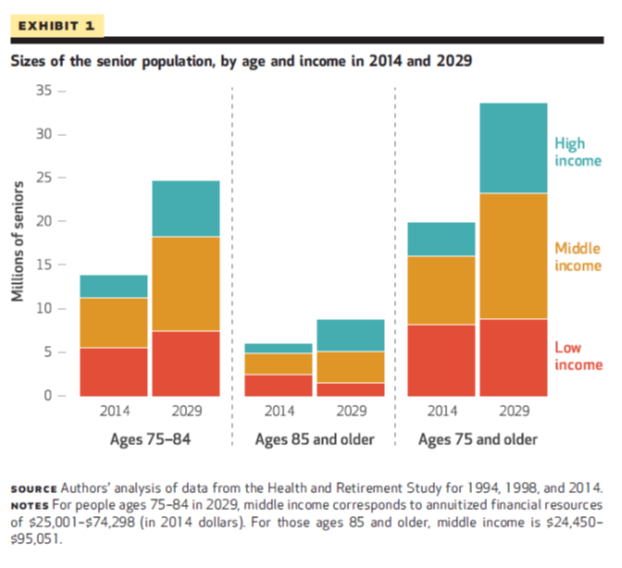

Middle-income seniors will grow in absolute numbers and will also account for a larger share of the total senior population, increasing from 40 percent of the senior population in 2014 to 43 percent in 2029, statistics suggest. Projections indicate that the number of middle-income seniors ages 75–84 will increase to 10.81 million in 2029. This is the age at which many persons begin to have health and mobility concerns that drive them to look for alternative living arrangements.

Savings rates for the baby boomer generation are much lower, in general, than they were for the previous generation. Some studies suggest that by age 80, the average person will have $128,000 in retirement savings, which can be supplemented by assets from the sale of a home. Even so, the average person 80 and older will have approximately $450,000 in savings available for long-term care, such as senior housing and services, not to mention all additional costs of living.

Figure 2 shows the senior population in 2014 and 2029. The middle market population is highlighted in the graphic in the orange bar.

Figure 2

Source: “The Forgotten Middle,” Health Affairs, 2019

Source: “The Forgotten Middle,” Health Affairs, 2019

As the middle market grows, it will also become more diversified. This is a trend in the country as a whole and not just our industry. By 2060, Caucasians will make up 43 percent of the U.S. population, suggesting the majority of seniors over time will be non-white. Baby boomers, statistics show, are not quite as diverse, with about 70 percent identifying as Caucasian.

Statistics show that 95 percent of residents and tenants in senior communities are Caucasian, which is due to many factors, including wealth and income disparity, cultural norms, homeownership, and others. The employee breakdown is more diverse, with slightly more than half of all employees in senior living identifying as Caucasian. Successful operators will do better at attracting a diverse senior population by hiring a diverse workforce.

Operators need to ensure that future living environments, programs and services, and corporate culture are geared toward a more diverse population and design marketing messages that appeal to the diverse middle market.

Your Opportunity

The opportunity to develop new options, expand into untapped or underserved markets, or convert old buildings to senior housing will continue for many years.

Although there have been developers and operators focused on low- and middle-income markets for senior housing, most newer developments have been targeting affluent and higher-end private payors. As a result, many markets are becoming saturated. Soon, the supply will be too great in many of these markets, and developers might eventually determine there is no opportunity for further development at all.

However, the middle is underserved in many of these same markets, resulting in opportunities for middle market developers to repurpose existing buildings for senior housing and AL care, find niche areas in markets overbuilt with higher-end supply, and target untapped markets with moderate income.

One challenge of developing for this market is matching expectations for returns on your investment with the actual price per square foot (or unit) that you will be able to achieve. The reality is that the rent you charge will need to be competitive or lower to attract the middle market. Coupled with the high cost of labor and construction, this might mean that your expectations on returns should be adjusted. Renovating and repurposing existing buildings might be a solution to increase the potential for greater returns on investment in the middle market.

No Frills? No Thanks!

One thing to keep in mind while looking at your floor plans, building designs, and mix of services is that the middle still expects some level of frills. While they might be willing to forgo some things, they will still demand high-quality care and modern living environments. Do not assume you can develop a building with downscaled amenities, smaller units, fewer frills, etc., to make it affordable and still be appealing to this population. Buildings targeting the middle will still need to provide common areas that enhance the living experience. Residents of AL facilities will still expect a desirable dining area and places to sit and enjoy family time outside of their bedroom/living unit.

The interest in amenities such as a restaurant-style dining option, beauty salon, gaming room, therapy pool, theater, convenience store, or coffee shop will be somewhat tempered by the realities of the cost. But it will be up to your marketing and sales team to appropriately match the message with the realities of your offering. Appeal to the cost-conscious nature of this segment of the market.

The key is to provide a quality living environment with things for the resident to do, while not going overboard and making the facilities appear high-end. You want to avoid perception that the building is unaffordable—perception is key to attracting the middle market. They want quality that is affordable and will not pay extra for all the frills.

Balance the desires of AL residents for private space with the need for affordable units. This is one way to develop smaller buildings or repurpose hotels or office space and still be able to provide desirable common spaces. Be aware that shared rooms are not the first choice of many middle market residents and family members. They will desire privacy. However, their budgetary reality might win out over the desire to have a private room.

Challenging locations that have good features should be considered, such as proximity to bus lines (for staff), health care, services, and areas where working-aged persons (adult children of seniors) live and work. Challenging locations might present space limitations for the amenities associated with higher-end facilities, making these spots more attractive for moderately priced senior developments. It is likely that sites “further out” from the most desirable locations will be more affordable for this type of development. One challenge is accessibility for sites that are further from core community services.

Middle Market and Assisted Living

One of the biggest issues senior housing developers will face as their communities mature after opening is the “acuity creep” of tenants and providing affordable solutions that do not require residents to move out to get services.

Eventually, you will need to figure out a solution for providing health care—even basic services—to your senior housing residents, or they will need to move out. Consider contracting or partnering with a local home health care provider. Joint ventures are not out of the question. Every market has plenty of home health care options, and a discussion with a few of them about an arrangement could be welcome. They need volume to make their business models work, and your facility could provide that.

For licensed AL options, you need to be aware that the high cost of care will drive residents to run out of funds. Keep in mind that the average length of stay in AL is relatively short, possibly two years, due to residents moving in older and sicker, running out of funds, and then moving to a Medicaid option. To keep them in your building, you will need to contract with the Medicaid waiver program for their AL needs. Residents running out of funds after paying for the higher cost of AL services for a few years is one risk of developing for the middle market. To avoid the issue, you will need to create options that are truly lower-cost and allow residents to stretch their funds further.

Again, repurposing existing buildings might be the better strategy to create a truly affordable AL option for the middle market. This might increase the probability that you will be able to make the situation work financially if you need to contract with the Medicaid waiver program.

Strategic Help Is Here

As a national leader in health care management and consulting services, Health Dimensions Group is uniquely positioned to assist your organization with strategic planning. If you’d like more information, please contact us at info@hdgi1.com or 763.537.5700.