Program of All-inclusive Care for the Elderly (PACE) is a fully capitated, fully integrated care program for adults age 55 or older living with chronic illnesses or disabilities. PACE has become the gold standard of care for the frail elderly. As the name suggests, PACE is an “all-inclusive” model of care, which means PACE organizations are at full risk and required to provide, or plan to provide, all service needs of their participants. The capitation payments received by PACE programs are all-inclusive as well. A complete understanding of PACE capitation revenues and funding sources is critical for PACE organizations to effectively manage risk and optimize financial performance.

This post will outline the key PACE funding sources and describe the mechanics of each component of PACE capitation revenue.

Integrated Revenue Stream

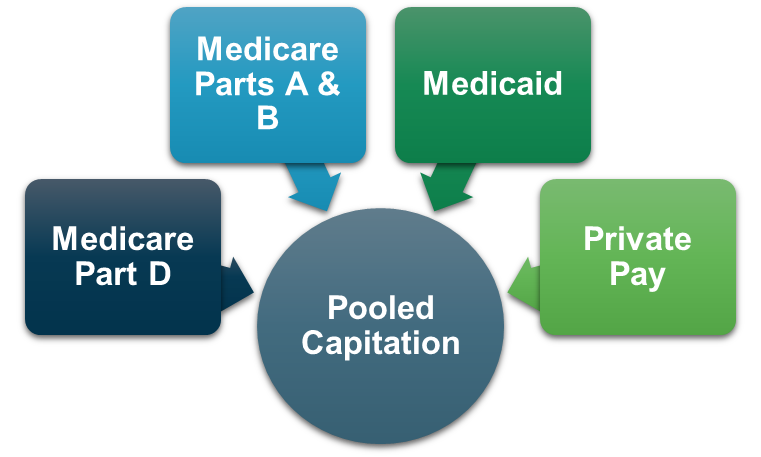

PACE payment features are unique compared to other health care payment models. Unlike fee-for-service health care programs, PACE has a capitated payment system in which PACE organizations are paid an amount per member per month (PMPM). Funding from multiple sources is combined to meet all participant care needs. This pooled capitation consists of four main funding sources: Medicare Parts A & B, Medicare Part D, Medicaid, and Private Pay (uncommon).

Due to the complexities and nuances of each component of capitation revenue, it is critical to understand each funding source.

Medicare Parts A & B

Capitation rates for Medicare Parts A & B are based on county-specific base rates adjusted for an individual participant’s demographic and diagnostic characteristics and an organizational-specific frailty adjustment that reflects the average level of functional impairment for each PACE organization’s participants.

The risk adjustment process described above is similar to the model used for Medicare Advantage organizations. The CMS-HCC (Centers for Medicare & Medicaid Services-Hierarchical Condition Categories) model is used by CMS to determine the participant-specific risk scores. The organizational-specific frailty score is based on responses to the Health Outcomes Survey-Modified (HOS-M) that is completed annually by PACE participants. The combination of these two factors represents the total risk score multiplied by the base rate to determine payment for the Medicare Parts A & B component.

A separate set of factors are used to determine risk adjustment for participants that are long-term institutional (LTI) or have end-stage renal disease (ESRD). LTI and ESRD participants account for less than 10% of PACE participants on average.

Participant-level risk scores are based on diagnosis codes submitted by PACE organizations to CMS through medical claims and encounters for the previous calendar year dates of service. Incomplete or inaccurate submissions can result in a material understatement of risk score and capitation revenues. It is very important for PACE organizations to have complete and accurate medical record documentation as well as a thorough process in place to ensure the accuracy of medical claims and encounter data submissions.

Due to a lag in the submission of risk adjustment data, and to allow PACE organizations enough time to submit complete and accurate data, participant-level risk scores are adjusted several times before final payment is received. Interim risk scores for each participant are determined and applied each January 1 and followed by a retroactive mid-year adjustment in June or July. A final reconciliation process does not occur until the latter half of the following calendar year. It is critical for PACE finance staff to monitor risk scores throughout the year and maintain risk adjustment settlement reserves to ensure accurate reporting of revenue in the proper fiscal year.

Medicare Part D

Medicare Part D revenues are based on a slightly more complicated risk adjustment process. PACE organizations are required to submit actuarially certified Medicare Part D bids to CMS prior to each calendar year. Once approved, these bids provide the basis for the interim base payment rate that is effective on January 1 each year.

As with the Medicare Parts A & B rates described above, the Medicare Part D rate is adjusted for a participant-level risk score. The RxHCC model used for Medicare Part D risk adjustment shares many of the characteristics of the CMS-HCC model and predicts the drug costs for each participant.

PACE organizations are required to submit prescription drug event (PDE) data throughout the calendar year. PDE is the detailed information for all prescription drugs issued to PACE participants and includes the actual cost to the PACE organization.

A final settlement process in which CMS compares the actual PDE cost to the interim rate based on the Part D bid is performed following each calendar year. As with the Medicare Parts A & B process described previously, it is critically important for PACE organizations to submit complete and accurate PDE data throughout the year and to maintain precise financial reserve models to ensure the accurate reporting of revenue in the proper fiscal year.

Medicaid

Unlike Medicare capitation rates that are based on a uniform formula across the country, each state has a different methodology for determining Medicaid capitation rates for their PACE organizations. The Medicaid rates are most often based on the costs of caring for a comparable population. This is referred to as an upper payment limit (UPL) or amount that would otherwise have been paid (AWOP). States will typically apply a percentage to the UPL or AWOP to determine the PACE rates. Some states have a risk adjustment component to Medicaid capitation rates, but most have a flat rate for all participants that are Medicaid eligible.

There are generally two different Medicaid rates that PACE organizations receive. The full dual-eligible rate is received for the participants that are eligible for both Medicare and Medicaid and represents, on average, 90% of a PACE organization’s enrollment. A separate rate is received for those participants eligible for Medicaid only. This rate is typically higher than the full dual-eligible rate to account for services provided that are typically covered by the Medicare capitation payment.

Unlike Medicare payments, Medicaid capitation payments are more prospective in nature and do not have the complicated settlement process as described above.

Private Pay

Private pay or Medicare only participants are uncommon in PACE. On average this accounts for less than 1% of total PACE enrollment. PACE organizations typically receive the Medicare Parts A & B payment for these participants, but the participant is required to pay the Medicare Part D and Medicaid full dual premium out-of-pocket. These private pay rates are very high because it tends to be a barrier for private pay enrollment.

Summary

There are many factors that impact PACE capitation revenues. Understanding the process involved in determining payment rates, the timeline for submitting risk adjustment data, and the process and timeline for determining final settlements is critical for PACE organizations to manage risk, maximize revenues and cash flow, and ensure accurate financial reporting.

About Us

As a National PACE Association Technical Assistance Center, Health Dimensions Group (HDG) has successfully assisted many organizations with PACE market and financial feasibility studies, program development and implementation support, and operational improvement. If you would like to learn more about how HDG can assist you in exploring PACE as a solution in today’s challenging health care environment, please contact us at 763.537.5700 or info@hdgi1.com and visit our website.